Table of Contents

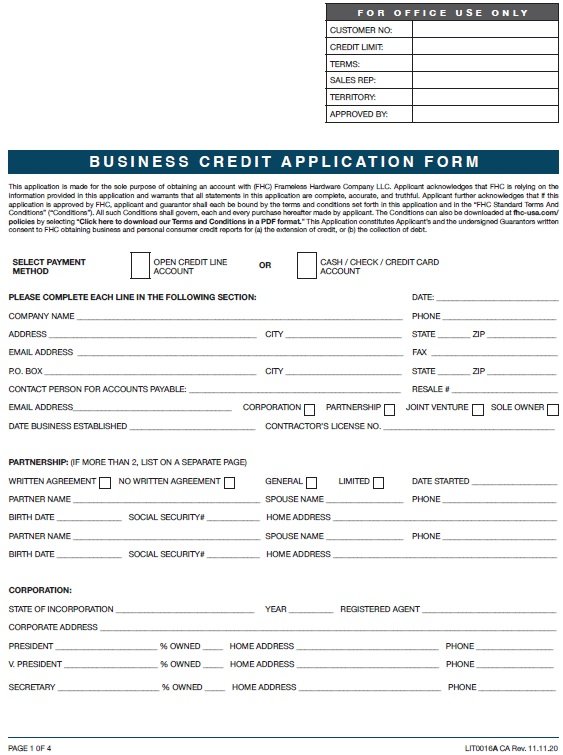

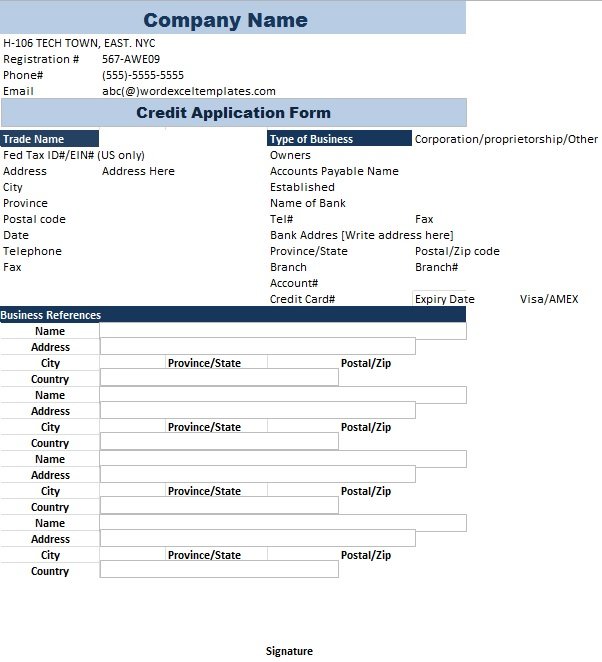

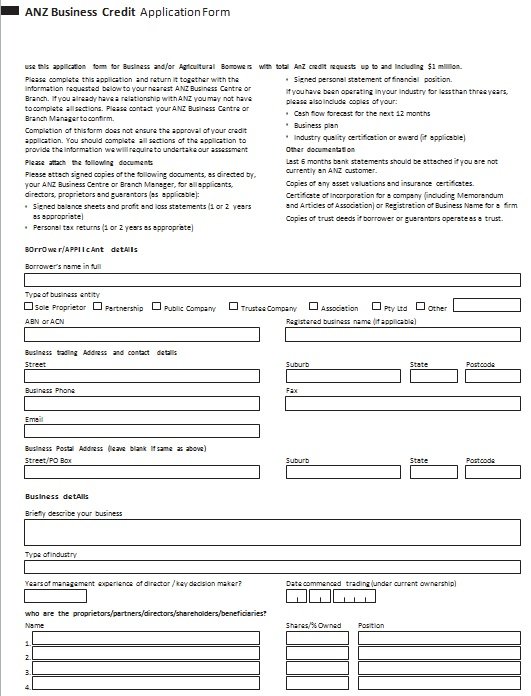

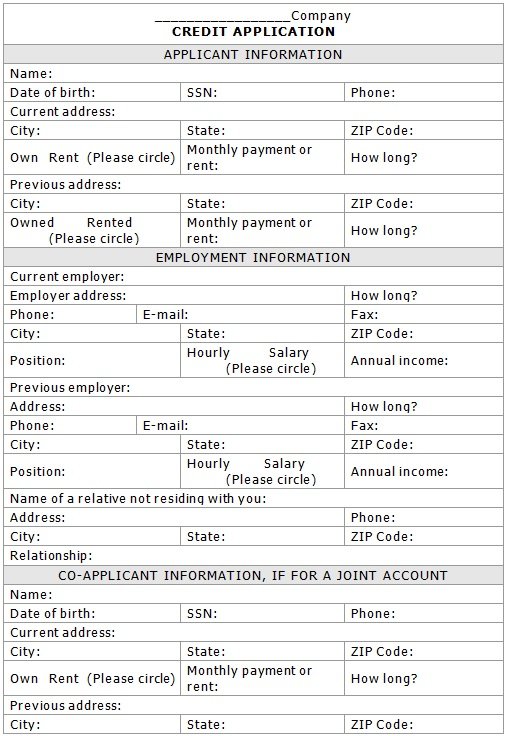

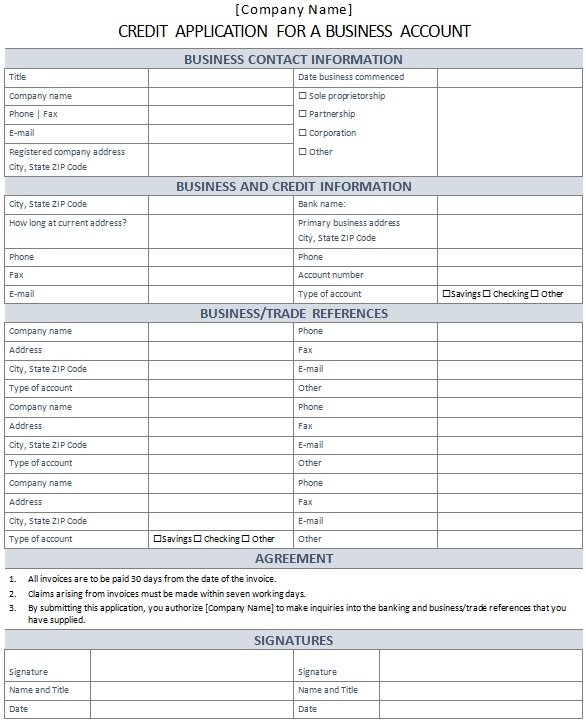

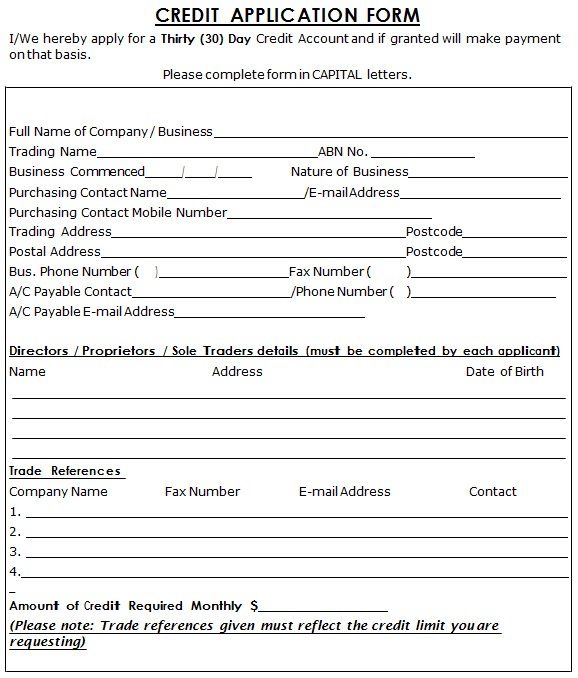

A business credit application template is a document used by a person or a company that needs credit to jump-start a business. The information that you give in this application will assist a financial institution in identifying whether you’re reliable enough to pay back your debts.

What are credit applications?

Credit card applications are generally filed by prospective borrowers. This application is submitted to lenders. You can submit this application via online or offline or in person at the premises of the lender.

Furthermore, the credit card application must give all necessary details without which the lender cannot proceed with the process. To process a business credit application, there are some lenders who charge a small fee. No matter what you plan to use the loan for, it is a requirement that you submit this application.

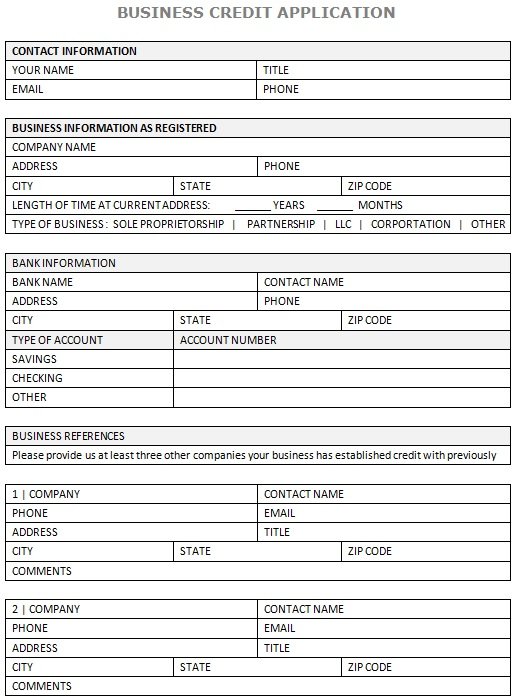

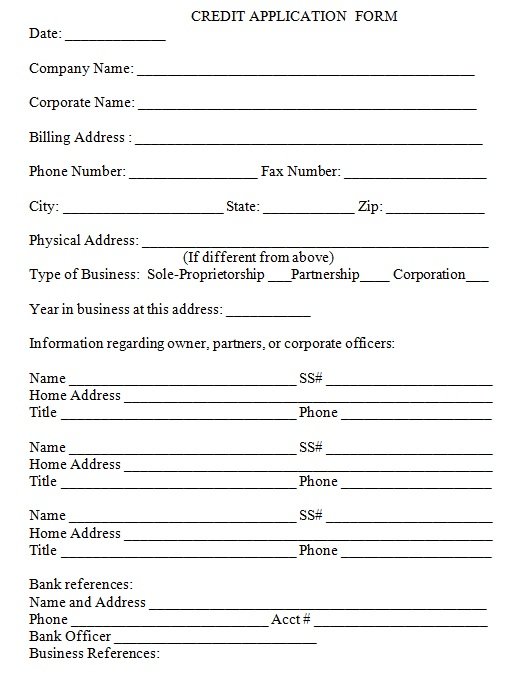

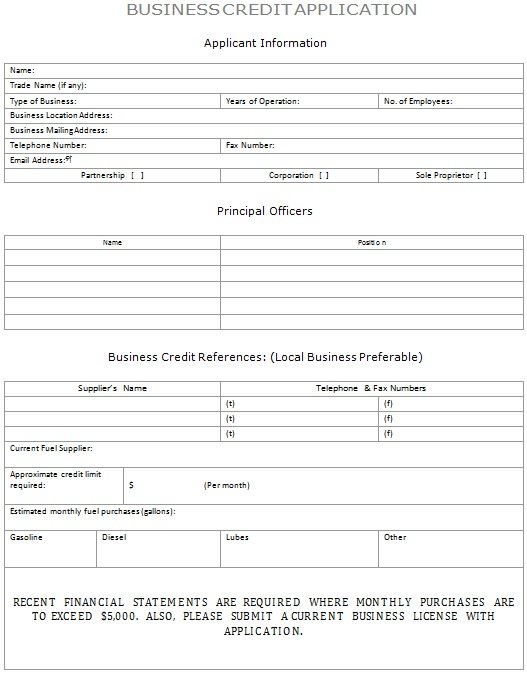

What to include in a business credit application?

You have to include the following information in your application;

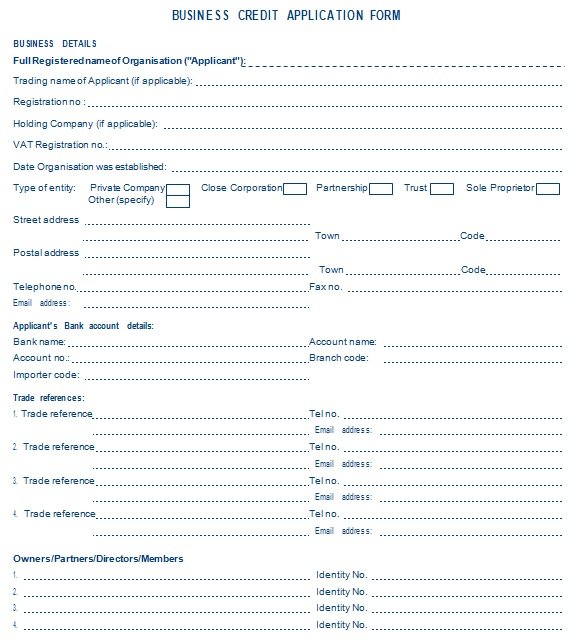

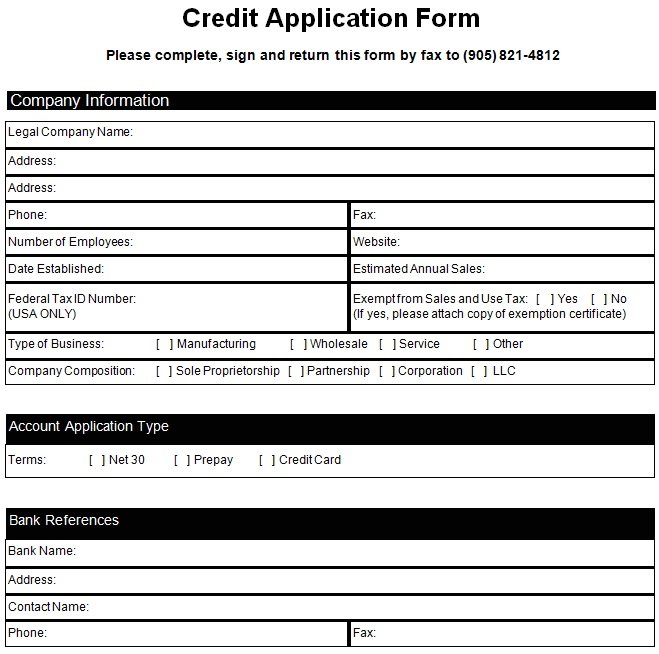

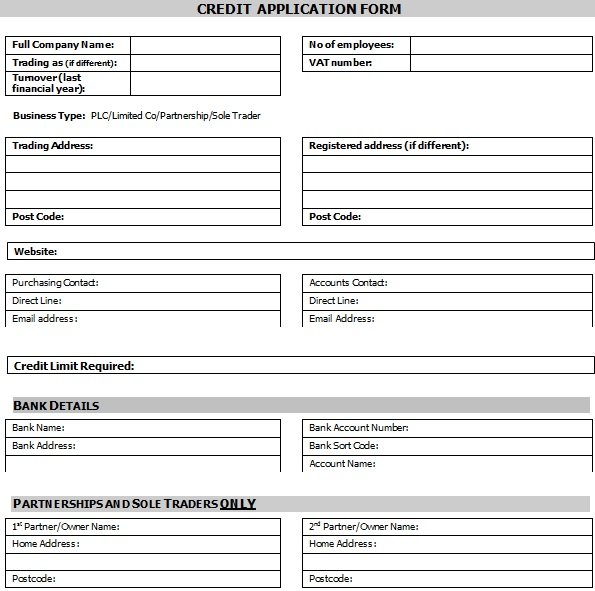

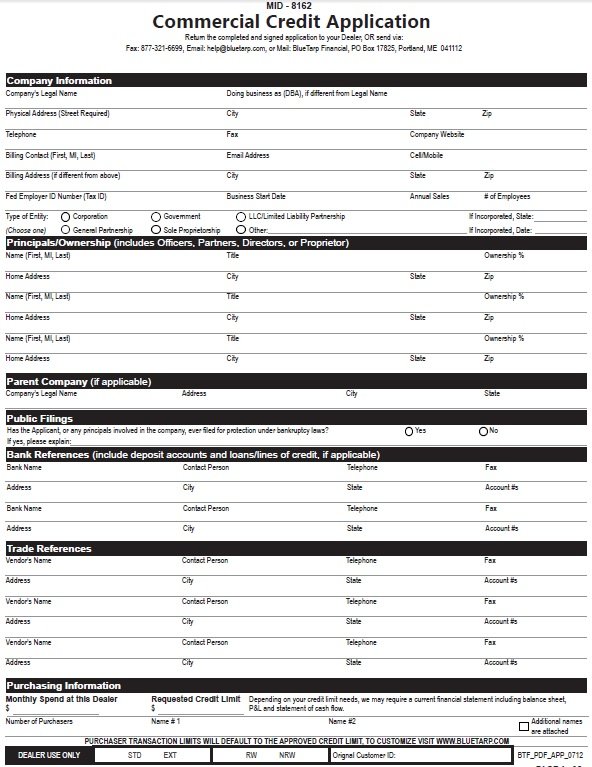

- You should also include your business name, address, and phone number

- The names of the principals

- The addresses of the principals

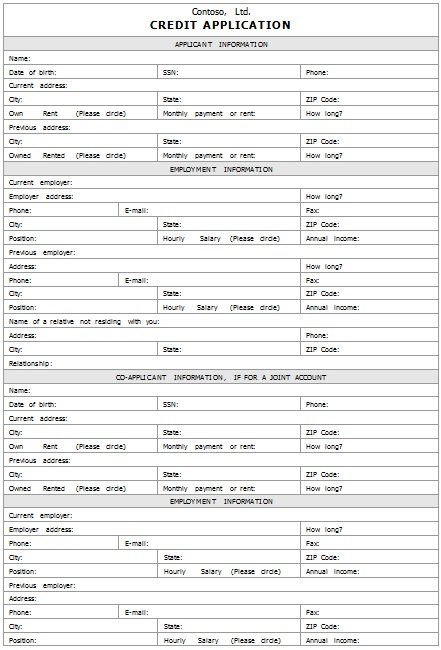

- The principal’s Social Security numbers

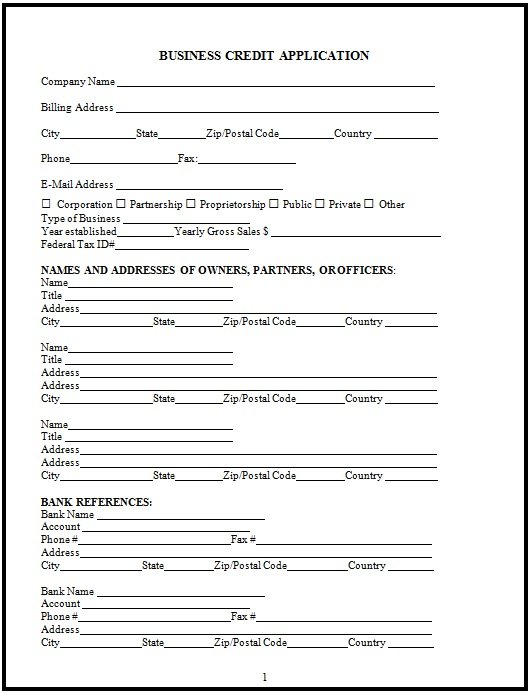

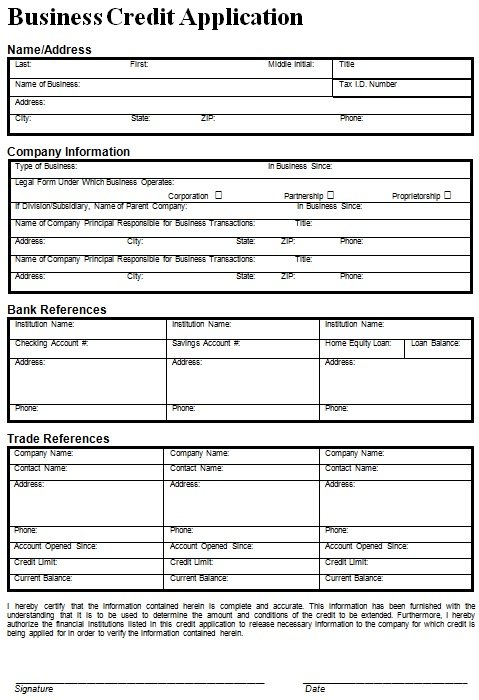

- The type of business you own

- The industry your business is in

- Your company’s employee count

- Trade payment references

- Bank references

- Personal or business bankruptcy history

- The entities under which your company does business

In addition to this, comprehensive applications may ask you to give financial information for them to evaluate the following;

- Financial Ratios

- Profitability

- Debt Levels

- Cash Flows

- Industry Evaluation

How to make online business applications?

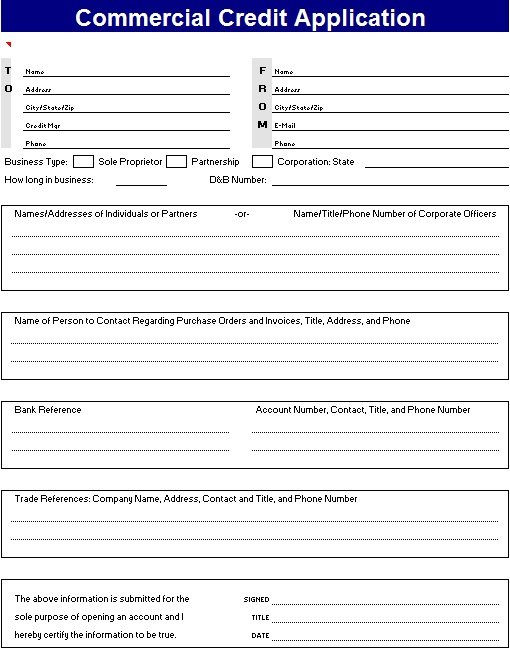

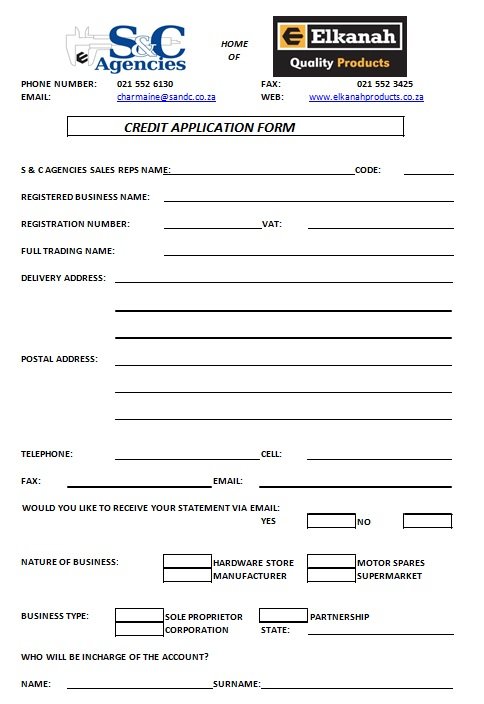

To make an online business credit applications form, you should include the following;

Contact details

In this section, you have to include basic information. You must know the following;

- Your client’s company name

- Shipping and billing address

- Tax ID

- Purchaser’s contact details

- The owner of the business

- Information about the officers

Business details

In the business details of your client, include their age, industry, parent company, legal status, and specify whether it’s exempted from sales tax or not. Your client also have to specify the credit amount requested.

Bank references

For any trade credit, the information given by banks is important. This is essential unless your client uploads these references along with their application. You need a signed agreement from your client to check for bank reference. You should also check bank statement templates.

Trade references

In the same industry, you need trade references from others. For example, you already know among your construction customers who can pay their responsibilities on time in case you’re a high-volume lumber distributor. Furthermore, there are some companies that only accept certain types of trade references. This is because they have a concern that they will only submit positive references.

Financial information

When requiring financial information from your clients, you should always be as specific as possible. In various companies, for smaller credit lines, companies don’t ask for financial statements. You should make sure to state in your application in case you’re satisfied to just get a recent statement reviewed by an accounting firm.

Terms and conditions

The terms and conditions in the application you have made, it is important for your customer to read and understand them. But, most of the people not goes through the terms and conditions. This is because they just scroll to the bottom of the form and click the “accept” button.

Your company’s legal team finalizes anything that involves terms and conditions. To improve the readability of this part of your form, your credit team should work with your legal team. This will enhance the chances of reading and understanding what you have written.

Conclusion:

In conclusion, the main goal of filling up a business credit application template is to identify whether you’re financially responsible and stable. In the application, provide your personal information, employment history, and required financial information.