Table of Contents

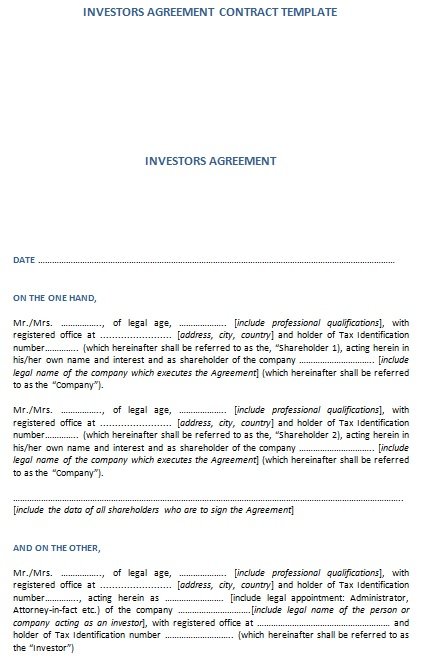

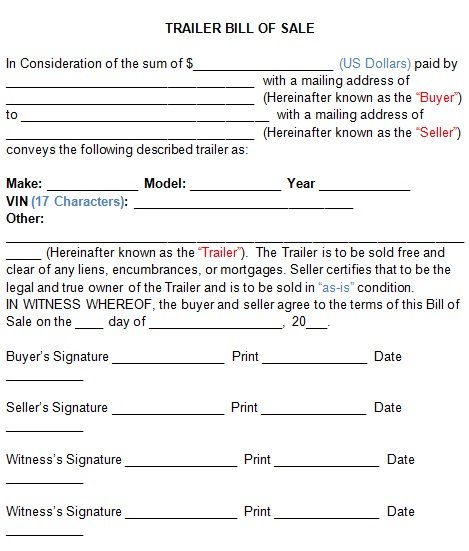

The investor would enter into an investment contract with a said company where they invest their money in for profit. The investment contract is an agreement that specifies the transaction between an investor and your company. According to the agreement, the investor gets an ownership interest in your company in exchange for some type of investment.

Types of investment contracts:

You should pay your attention to the required documents that you will need to make your agreement when you have found an investor who wants to invest in your company. But, you must ensure that you have a good understanding of the outline investment terms before making your investment contract sample.

Let us discuss below some different types of investment contracts;

Stock purchase agreement

In this type of investment contract, the investor in exchange for capital gets a percentage of the shares in the capital stock of your company. The investor becomes a shareholder of your company when you have completed the investment transaction.

Stock option agreement

This agreement can be qualified as non-qualified or qualified stock options. By having stock option, your investor has the chance to buy your company’s stocks in future. They purchase it at a price determined when you grant the options. Furthermore, the main aim of this agreement is to provide the investor the opportunity to purchase company stocks in the suture at a fixed price.

Convertible debt agreement

The convertible debt agreement involves a business or person who agrees to lend money to a company. They agree with the option that in your company they can convert the money they loaned into an ownership interest. This agreement indicates who has the option to convert their debt into equity. You may also like the employment contract template.

Restricted stock agreement

As per this agreement, the investor gets issued shares by the company in exchange for their effort and time into your company for a particular period of time. In addition to this, the investor can’t claim ownership of your company stocks if they fail to contribute their effort and time over the set period of time.

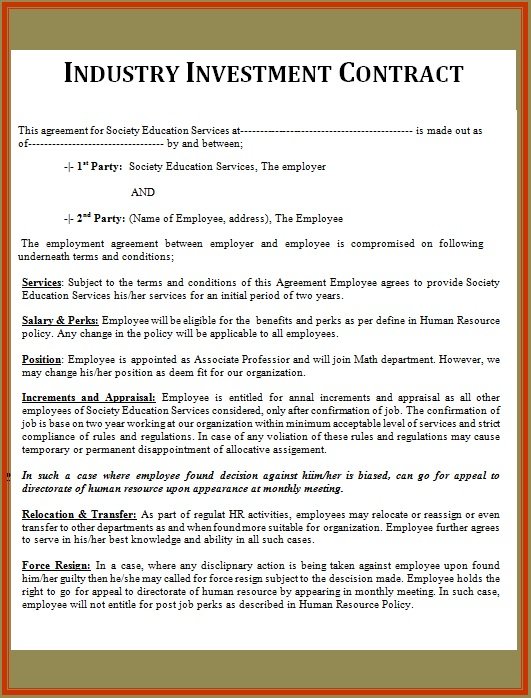

Deferred compensation

Actually, this isn’t an investment contract. This is because the investor doesn’t get equity ownership in your company. In this kind of agreement, in exchange for a salary, a bonus, or compensation, a person will agree to work in your company.

What to include in an investment contract?

You may use an investment contract for the following situations if you own a small business;

- If you’re interested in investing in another business.

- If you want to bring investors from outside your company into your business.

Furthermore, your transactions get subjected to the following if one of them qualifies as an investment;

- Reporting

- Registration

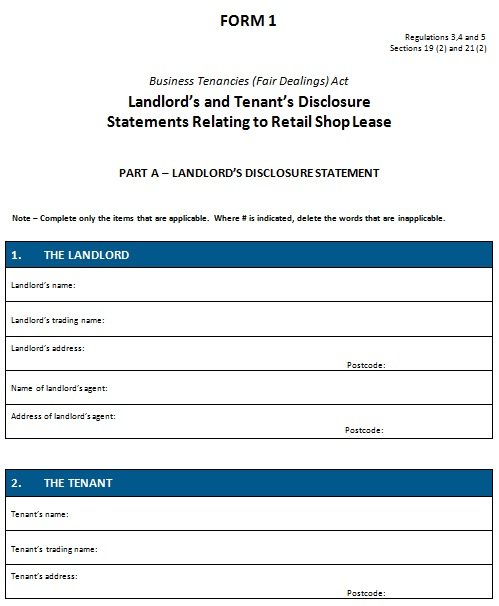

- Disclosure requirements

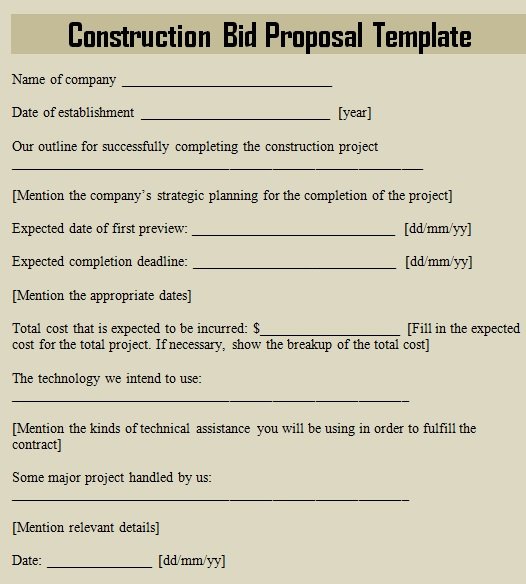

Basically, this agreement demonstrates the terms of the investment. It further explains when and how the investor would expect their Return of Investment (ROI). Ensure your contract includes the following information;

- Names of the participating parties

- Addresses of the participating parties

- The investment’s basic structure

- The investment’s purpose

- The date of the agreement

- Signatures of all the participating parties

For investors, it would be a good idea to look into any significant business documents who want their investment to be in the form of ownership shares in your company.

Additionally, a good agreement should also include the;

- The total amount is given by the investor

- The form of the investment

- The specific time of transferring the investment

Conclusion:

In conclusion, by having an investment contract template, the investor makes sure that their investment is completely protected and the company ensures that their funds get delivered smoothly.