Table of Contents

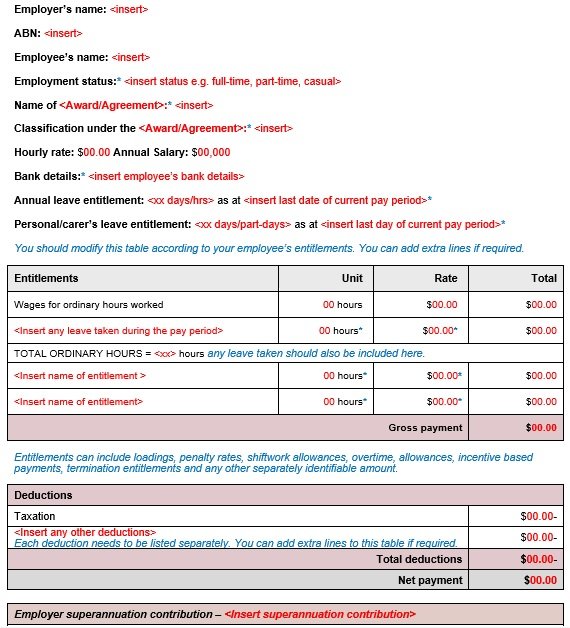

A payslip template is a tool used by employers to draft salary receipts for their employees. It is an official document that contains all the relevant and essential payroll data. It serves as an important record of your employment.

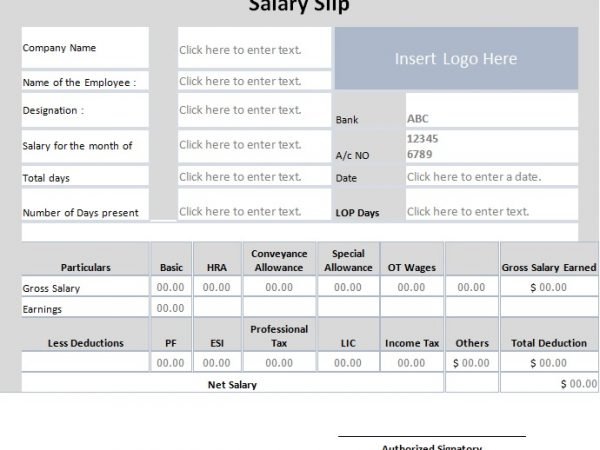

The format of the payslip:

There isn’t a standard format to prepare a payslip. However, it includes a huge amount of details. The payslip usually consists of two parts;

Incomes: this section includes the following;

- Basic salary

- Dearness allowance

- House rent allowance

- Conveyance allowance

- Leave travel allowance

- Medical allowance

- Performance bonus

- Special allowance

Deductions: this section includes the following;

- Provident fund

- Professional tax

- Tax-deductible at the source

The importance of a payslip:

A payslip is of great importance for every employee and for the organization. It shows that salary is granted to an employee by the organization. Moreover, it is a valid proof of a person’s employment in a particular organization. The payslip is also considered an authentic tool for the verification and identification of a person. Some other benefits of the payslip are;

- A payslip identifies how much tax you have to pay and how much refund you can claim. Thus, it forms the basis for income tax payment.

- You can get access to various facilities such as subsidized food grains, medical facilitation, etc.

- You may also need a payslip while availing loans, mortgages, and other borrowings.

What should be included in a payslip?

A payslip should include the following details;

- The complete name of the employee

- The employee’s complete address and postal box number

- The amount of salary

- The amount of direct taxes applied to the salary

- The deductions that are made from an employee’s salary

- Complete name, address, and logo of the organization that is awarding the salary

- Sometimes the salary slip also contains the bank account number of the employee

How to create a payslip template in Excel?

Consider the following steps to create your payslip template in Excel;

- First, provide general information about the company such as the company name, address, phone number, logo, and other details about the company.

- Then, state which month your salary is paid for.

- After that, provide all the details about the employee including their name, ID, designation, department, date of joining, and location.

- Next, you have to specify the bank account number and bank name of the employee.

- Input the period of paid days, LOP days, and days in a month.

- After inserting the employee and employer details, you should enter salary details. In addition, mention other earnings such as incentives, bonuses, overtime, etc.

- When you have done with the earning part, specify the deductions which include provident fund, professional tax, income tax (TDS), or salary advance. You have to be very careful while including these details. The calculations of income tax should according to the rules and regulations of the government. After deducting exemptions, calculate the TDS. It would be recommended to hire a good professional who is an expert in these matters.

- Apply the formula to determine the net pay amount.

Net pay amount = Total Earnings – Total Deductions - You can use the payslip format after identifying the net payment.

FAQ’s

The main purpose of a payslip is to indicate to an employee how much they have been paid for a specified period. It also indicates to them any tax that is deducted from their overall pay and other deductions.

Arial is a widely used font for payslips. It is often used in various business documents because of its clarity and readability.