Table of Contents

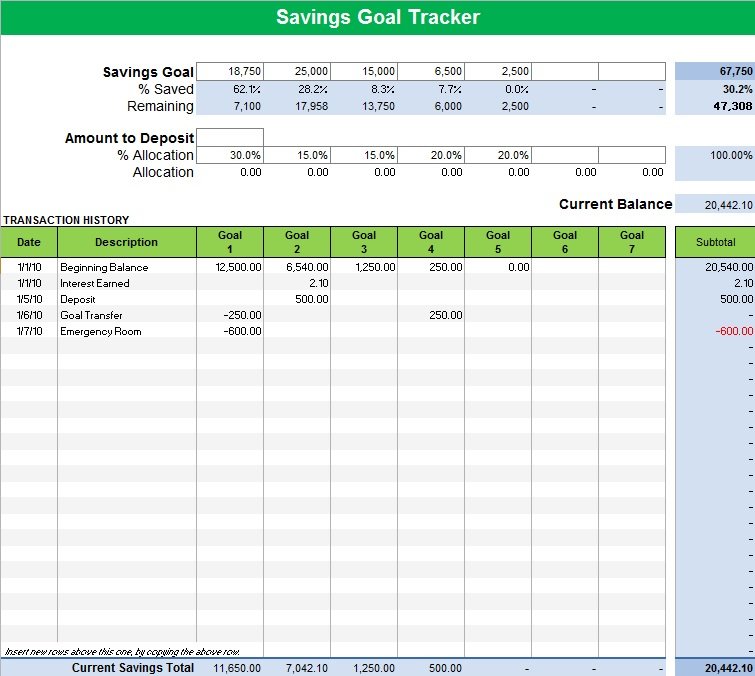

A savings goal tracker template is an effective tool used to track your savings. This tool helps you in tracking your savings and taking control of your money in case you don’t have the habit of saving money and you want to spend money less than you earn. The savings goal tracker is the best way to achieve your saving goals.

Moreover, the savings goal tracker spreadsheet includes budget categories such as emergency funds, vacations, and a bigger home for your savings. This means you spend your savings on the things you indicated in the spreadsheet. You can calculate how much money you assigned for every goal. You may also like Smart Goals Worksheet.

How do you use savings goal tracker spreadsheet?

At first, consider your savings amount as your “expense.” The spreadsheet includes a budget category for your savings such as;

- education fund

- emergency fund

- saving for your travel or education

Split is a single transaction to various budget classification. The money is allocated to multiple saving goals when you deposit in your savings spreadsheet. When you make a transaction, write the date and the description of the transaction. Furthermore, specify how much you assigned for each goal. It is beneficial to achieve your goals.

The benefits of savings goal tracker:

Let us discuss below some benefits of the savings goal tracker;

- The savings goal tracker assists in tracking your savings and managing your budget.

- It is a helpful tool to take control of your money spending.

- With the help of savings goal tracker, when you set your priorities then it is easier for you to save your money.

- When it seems difficult to achieve your savings goal, it is helpful to make changes.

- You meet your timeline easily by setting your savings goals with the help of saving a goal tracker spreadsheet.

- This assists you in fulfilling your dreams that can’t be met due to financial issues.

- The savings goal tracker makes you financially strong.

- It is a type of personal daily expense sheet that helps you in focusing on your savings goals.

How to create a savings budget for your savings tracker?

Here are the steps that you should follow to create a savings budget;

- At first, you should have a good understanding of the “paying yourself first” concept. This is a technique that is suggested by a lot of financial analysts. As part of your saving plans, you set SMART goals.

- To create an expense tracker, use a journal or a computer spreadsheet. At the top, list the types of expenses. Then, under each of the columns, entries for costs in the rows. At the end of each month, total all of your expenses. This way, you take a clearer idea of how much you spend.

- You should also include yearly and occasional expenses to the expense tracker.

- Next, multiply that total you got by 12. Then, from your yearly or occasional expenses, add to this the total amount.

- You have to go back in case your expenses exceed your pay and check where you can make adjustments.

- In the next step, compare your goal to the difference between your take-home pay and your expenses.

- In the end, divide your yearly savings goal by how many paychecks you get in an entire year. This way, you identify an amount that you should put toward your savings each time you obtain a paycheck. You may also see Weekly Budget Templates.

Conclusion:

In conclusion, a savings goal tracker template is an effective tool that keeps track of your savings goals from start to finish. This is the beneficial document to achieve your goals. You should determine all the expenses you spend in the course of one month before creating a savings budget for your savings goal tracker.