Table of Contents

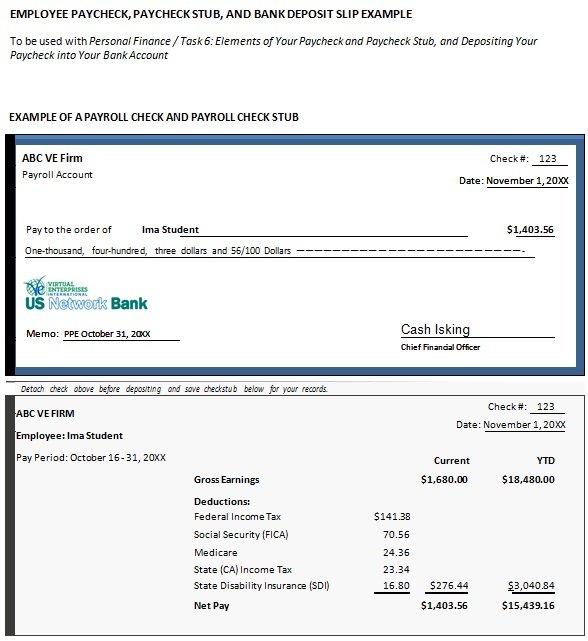

A pay stub template is a piece of paper attached to a paycheck. It includes information concerning to a payment mode. This document serves as proof of income or as a reference for tax deductions. It is an employer’s responsibility to provide this document that verifies employees’ earnings for a particular period of time. Additionally, don’t issue a fake pay stub template because it may cause a lot of serious issues for the employee.

It makes sure the legal work relationship between an employer and the employee. Nowadays, companies don’t require paper documents as they have opted for a digital workflow. It saves time, effort, and money because you don’t want to print out documents. You may also like Salary Slip Format in Excel.

What to include a pay stub template?

Commonly, pay stubs basic information divides into three main components. They are as follow;

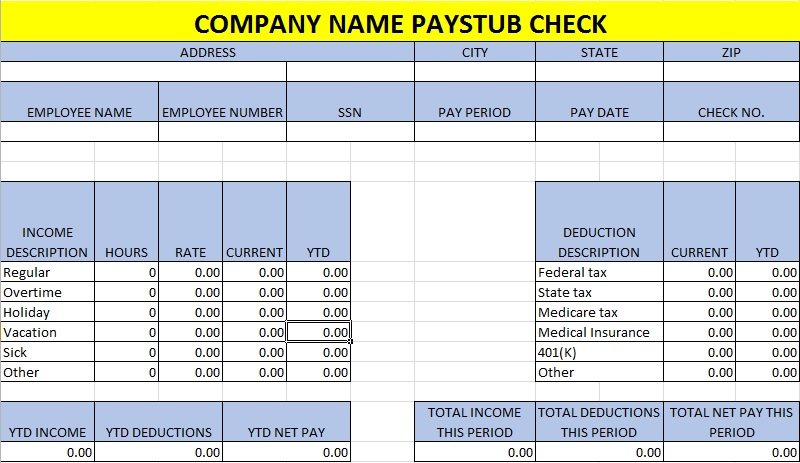

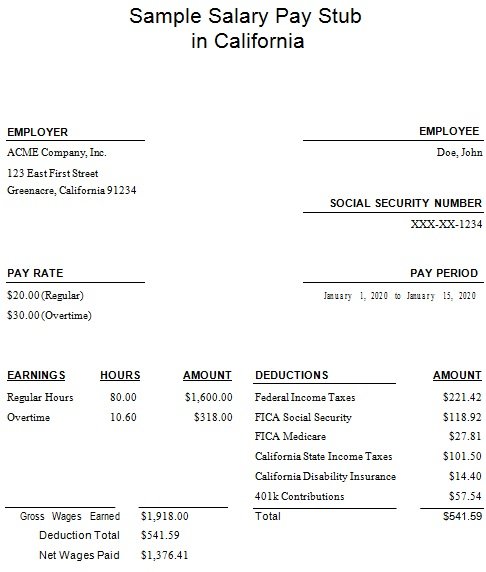

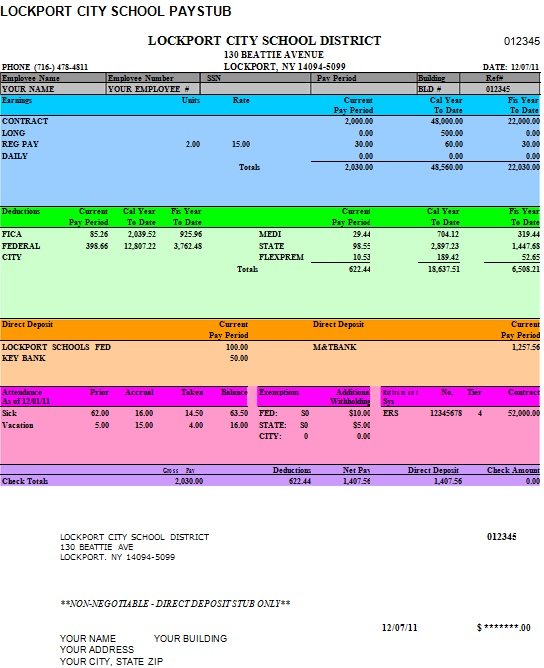

1. Information about your company:

Company’s information includes company’s business name and address; you can place this information either at the bottom or the top of the stub.

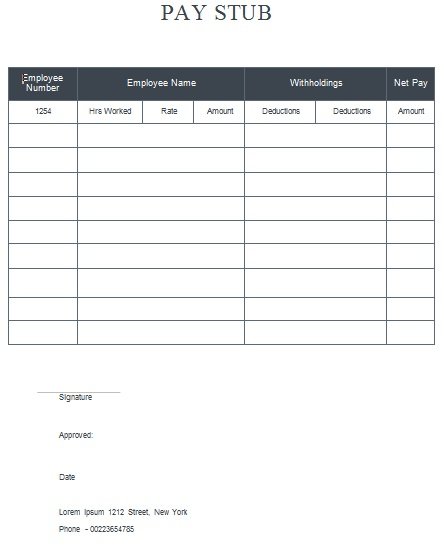

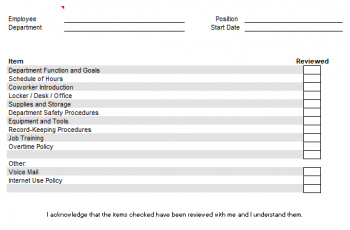

2. Information about the employee:

This section contains the employee’s complete name ID number, and their Social Security information. In case of email, you should also include the employee’s address. It’s better to organize this information at the top row of stub.

3. Payment details:

It is the most extensive part of the stub. This section contains a precise summary of how much your employee has earned in a certain period of time. It consists of the following information;

Check number:

The number you issue to an employee is known as check number. You can use this number when you need to track down or cancel a check.

Pay date and period:

It is the date when you issued the check. After the end of the pay period, this is a couple of days. Pay period indicates the starting and ending date of the applicable pay period.

Types of Income and Amounts:

The most important information on the stub is types of income and amounts. It consists of number of hours your employee worked. For each income type, the amounts they have earned, this document specifies it.

Moreover, regular or wages and tips for tippable workers are included in income types. For both the certain pay period and the total tax year-to-date, provide amounts and hours.

Deductions:

In this section, you have to list down both the YTD and the current pay period. State Tax, Federal Tax, Social Security, and Medicare are the common deductions. In the end, the stub has an itemized list of amounts deducted and the total amount of all the deductions.

How to create a pay stub?

Here are the steps on how to create a pay stub;

- At first, select a program to calculate your employees’ paychecks. Choose a spreadsheet program and then start by creating columns for deductions, net pay, and gross pay.

- Now, calculate the gross pay by dividing the annual salary of the employee by the number of paydays in a year.

- Next, calculate the deductions that come out of your employee’s paycheck. The deduction amount depends on the employee’s status that whether he is the head of the household or married.

- After that, calculate the net pay, the amount left after making additions and deductions to the employee’s salary. This amount will receive by the employee.

- In the end, make a template for your employee’s stub. If you want to make your own template then it will require more effort and time. You can also do this easily by using a generator to create stubs online. With the help of generator, you can produce a professional stub.

Conclusion:

In conclusion, a pay stub template is a helpful tool that assists you and your employees in managing your finances. It is a piece of paper that acts as evidence of income or as a reference for tax deductions.